Taxation in Denmark

Characteristics of the Danish tax system

Danish tax rates exhibit a high degree of flexibility and adaptability to income, whether earned by legal entities or individuals. The ability to take into account various expenses, such as pension contributions, insurance, living expenses, as well as travel costs between residence and work, is fully accepted. An important element is that the Danish Tax Authority (SKAT) has a period of up to seven years to conduct audits to verify the compliance of these expenses.

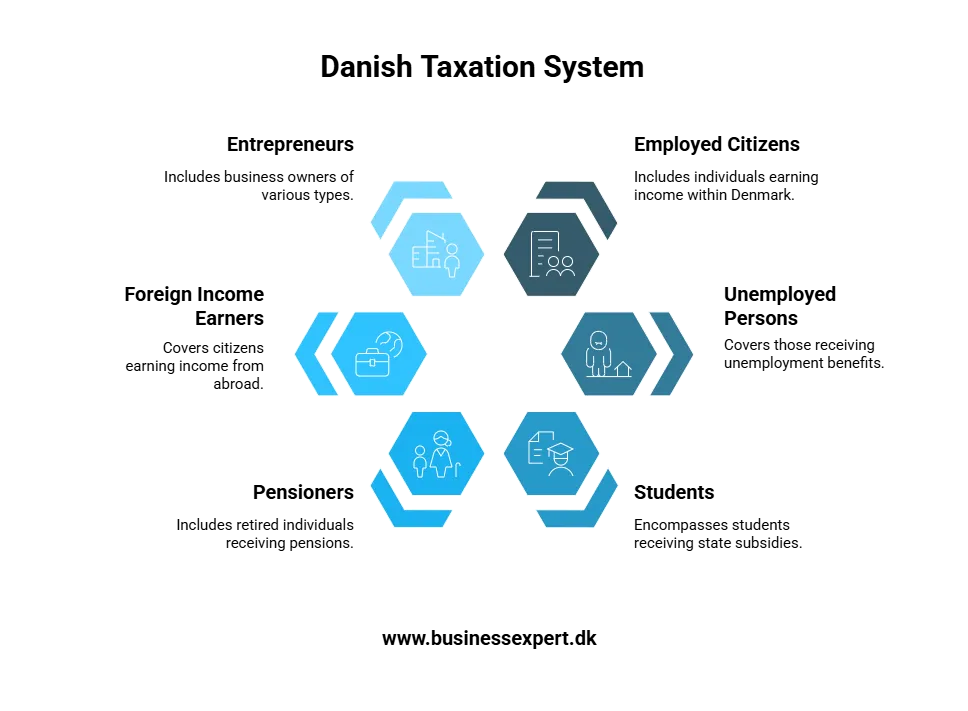

Different classes of entities in Denmark are subject to different tax rates - employees of Danish companies, independent entrepreneurs, company leaders or shareholders.

Highlights of taxation in Denmark include:

- For 2019, income tax rates are as follows:

- 8% for income below DKK 50,217,

- 39.2% for income between DKK 50,217 and DKK 558,043,

- 56.5% for income above 558,043 DKK.

- The range of legal norms governing taxation in Denmark includes:

- Personskatteloven - personal income tax,

- Skattekontrolloven - tax control regulations,

- Kildeskatteloven - regulations relating to source tax,

- Ligningsloven - regulations related to the evaluation of taxation.

- Taxes include both national taxes, local taxes, health insurance contributions (sundhedsbidrag) and contributions to the labor market (arbejdmarkedsbidrag, or AM-bidrag). It is worth mentioning that about 0.92% is a voluntary tax donated to the church.

- In addition, the municipal tax, which is allocated to local governments, averages 24.92%.

- The registration process with the local Customs and Taxation Office requires interaction with the Enterprise and Trade Agency.

- Taxation related to income derived from shares is 27% (for income up to DKK 54,000) or 42% (for income exceeding DKK 54,000).

- If the company operates in Denmark, the corporate tax rate is 22% CIT. However, if the company achieves an annual turnover of more than DKK 50,000, it becomes an entity paying 25% VAT.

- For exports of goods and services, the VAT rate is 0%, but purchasers can deduct tax on their purchases.

- The accounting period in Denmark coincides with the calendar, so income from the previous year (or other 12 months) is the tax base.

- Employees of Danish companies may be subject to full or limited tax liability (begrænset skattepligt), depending on their contract and place of residence

- The obligation to file a tax return with the Danish Tax Authority (SKAT) is valid for 3 years.

- In 2019, the tax exemption limit was DKK 46,630. This means that people whose income in Denmark was less than this amount were exempt from taxation.

- Filing a tax return in Denmark must be done through the website within six months of the end of the tax year. If the tax year ends between February 1 and March 31, the return must be filed by August 1, and the tax fee paid by March 20 and November 20.

- Denmark's taxation structure includes:

- church levy (kirkeskat),

- local tax (kommuneskat),

- pension contributions (ATM),

- employee contributions,

- health insurance premiums (sundhedsbidrag),

- land value tax (Ejendomsværdiskat), which is levied on all residents of Denmark. This covers real estate, regardless of location. The rate is 1% for values up to DKK 3.04 million and 3% above that amount,

- a tax on the value of real estate, determined through a public valuation process,

- a tax on the hiring of foreign workers, imposed on Danish companies employing workers from outside the country, at a net rate of 38% to 35.6%, including an 8% contribution to the employment fund and a 30% tax on the hiring of labor, paid to the Danish Tax Office,

- tax on the income of both individuals and legal entities,

- source tax, deducted from income,

- as well as indirect taxes: customs duties, environmental taxes, excise taxes (punktafgift), VAT (moms).

The Danish tax system is quite extensive, so it is advisable to familiarize yourself with the regulations, rates, documents and tax deadlines before starting a business or employment in Denmark.

Tax issues from a business perspective

Taxation in Denmark applies to all citizens present in the country who earn income, whether they are unemployed persons benefiting from a-kasse, students receiving state subsidies, pensioners, or those working abroad and earning income from outside Denmark. Entrepreneurs who operate various types of businesses (such as sole proprietorships, joint stock companies, general partnerships, limited liability companies, limited partnerships, branches of foreign companies or cooperative associations) are also subject to this taxation system.

The Danish Tax Authority, known as SKAT, considers income generated by business activities as income of the business owner. Accordingly, business taxation is reported through a single tax return. Business owners who pay taxes and contributions are entitled to pension and health benefits analogous to those enjoyed by employees working in Denmark.

Once every six months or quarter, using the SKAT online platform, it is necessary to submit a tax return covering both income tax and VAT. Income tax advances must be paid by March 20 (there is also an option to pay a higher advance payment in order to receive a tax refund with interest, which is higher than at the bank) and November 20 (in this case, interest is slightly lower by 0.4 percentage points than at the bank).

When setting up and operating a company in Denmark, corporate taxation of 22% applies. If a company's annual turnover in Denmark exceeds DKK 50,000, the company becomes liable for 25% VAT.

Employment in Denmark of an employee from another European Union country

In the context of free movement among the countries of the European Union, no specific criteria need to be met in order to be approved for employment in Denmark. Nevertheless, there is a requirement to register with local social security and tax authorities.

An example of this is the situation of Jean, a French consultant who received an interesting job offer from a Danish end client, in cooperation with ABC. After applying, he was selected for a six-month project that required full-time work in Denmark. Jean, a consultant, signed a contract based on hourly or daily wages, and his qualifications were accepted by the client. Under this contract, Jean works in Denmark according to the agreed terms between ABC and the client.

From the first day of work, Jean, a French consultant, is required to pay taxes in accordance with international employment regulations. If Jean decides to detach himself from his ties to France, such as residence, family or economic interests, and focus solely on his employment in Denmark, he will be subject to limited tax liability in this country.

Employment in Denmark and the double taxation treaty

The purpose of a double taxation treaty is to protect entities from situations of double taxation. Through bilateral tax treaties between Denmark and other countries, tax payments levied in the country where the employee is employed may be reduced by the amount of tax due in the country of residence, or income earned in the country where the employee works is taxed only once (in the country where the income is earned), and is excluded from taxation in the country of residence or domicile (citizens are required to pay tax in the country with the higher tax rate).

Levels of taxation in Denmark

There are three levels of taxation within the Kingdom of Denmark:

- for incomes less than DKK 50,217, a tax rate of 8% applies,

- incomes between DKK 50,217 and DKK 558,043 are taxed at a rate of 39.2%,

- income exceeding DKK 558,043 is taxed at a rate of 56.6%, one of the highest levels in all of Europe.

Tax obligations of legal entities in Denmark

All corporations in Denmark, from cooperatives and associations to Danish limited liability companies, joint stock companies and foreign branches based in the country, are required to settle income tax on their general income (which includes income from capital and property) within six months of the end of the tax year.

What's significant about this system of taxing corporations?

- An income tax rate of 22% applies.

- Non-resident foreign companies pay 22% tax only on income generated in Denmark.

- The same 22% tax rate also covers capital gains that are included in a company's income in Denmark.

- Capital gains related to the sale of shares in companies, share groups, portfolio shares and shares in subsidiaries are not taxed if you are a Danish shareholder.

- The final capital gain from the sale of listed portfolio shares is taxed at 22%.

- If a non-Danish shareholder sells his shares in a company based in the country, the capital gain from this transaction is not subject to these specific taxes.

- All local companies that act as energy suppliers are required to pay environmental taxes and keep accounts with the relevant Tax Office.

- Income generated by central corporate headquarters in Denmark is matched against the income of foreign subsidiaries (although profits from these foreign subsidiaries may be exempt from taxation in Denmark).

Tax-free amount

VAT

Denmark has a unified VAT (MOMS) of 25%, applicable to both products and services. However, there are some exceptions where certain services are exempt from this taxation, such as:

- travel services,

- services related to funeral ceremonies,

- social support,

- health care,

- financial transactions,

- insurance,

- artistic fields and culture,

- charitable activities,

- real estate trade,

- sports fields,

- video entertainment,

- passenger transportation,

- postal fees.

Despite the 25% VAT rate, there is also a zero rate (0%), which covers goods and services intended for export. The amount of this tax can be deducted by those purchasing these products and services.

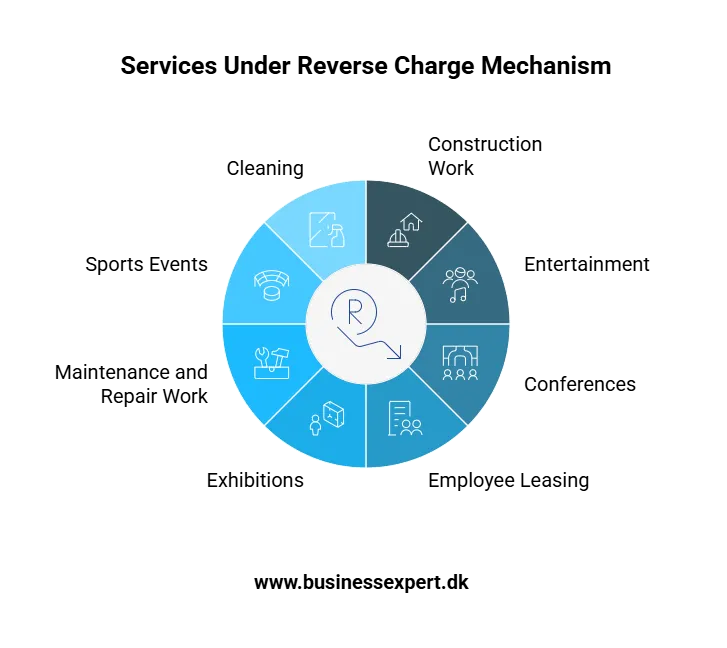

The following services are subject to the reverse charge mechanism:

- construction work,

- entertainment,

- conferences,

- employee leasing,

- exhibitions,

- maintenance and repair work,

- sports events,

- cleaning.

Additional important aspects regarding this tax:

- All Danish companies with an annual turnover of more than DKK 50,000 are required to pay VAT.

- The standard VAT rate is 25%.

- The 25% VAT rate covers almost all services and industrial goods.

- Some services, such as health care, education, cultural activities and banking services, are subject to a 0% rate.

- Foreign workers employed for a period of 3 months to 3 years, earning at least DKK 47,500, are subject to a 25% fixed income tax with an additional 9% labor market contribution.

- Companies offering products and services in Denmark are required to pay a uniform 25% VAT, which is added to the final price of the product or service.

- Registration of the company as a VAT payer should be done within 8 days of starting operations, and this process is possible through the portal of the Registry of Foreign Suppliers (RUT, virk.dk).

- The reverse charge mechanism allows companies from abroad to supply services and goods to Denmark without charging Danish VAT. In this situation, the net value of the product or service is shown on the invoice.

- Recipients of services in Denmark, even if they are not registered as VAT payers, are required to register and pay VAT.

CIT tax

Denmark's corporate income tax is a key source of state funding and contributes significantly, about 8% of total government revenue. Its role is to tax the profits of companies operating within the country, also covering income earned from capital investments.

Here is some important information regarding CIT:

- The corporate income tax rate is 22%.

- Legal entities, such as limited liability companies (also known as Ltd in Denmark) and joint stock companies, are subject to CIT. In the case of partnerships, only the partners of these companies are subject to the tax.

- In Denmark, companies are taxed on a consolidated basis. This means that the parent Danish company, its branches and subsidiaries are taxed.

Excise tax

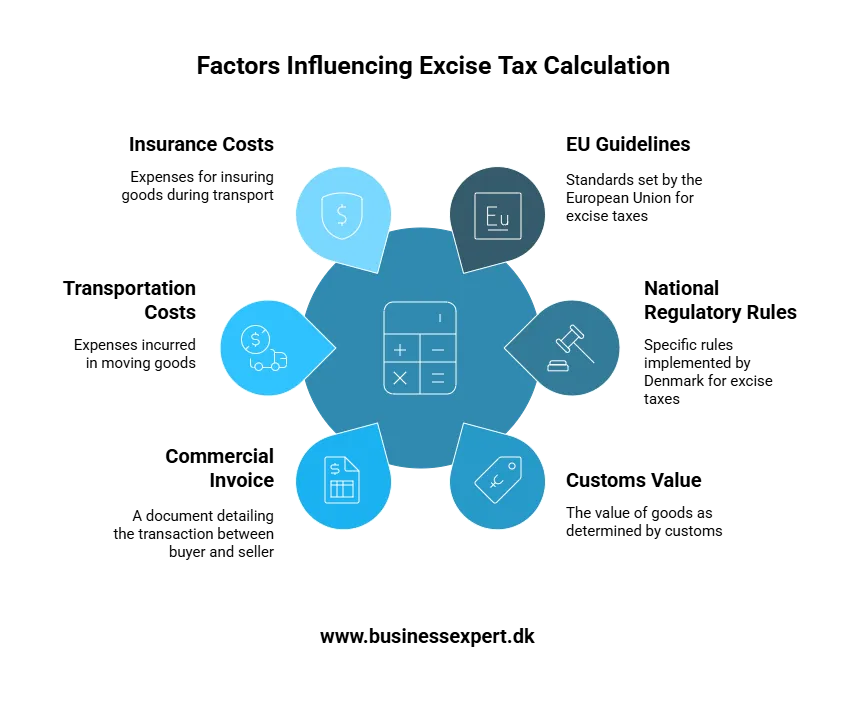

Excise tax in Denmark is applied in accordance with European Union guidelines and according to national regulatory rules, covering a variety of items such as candy, cigars, chocolate, chewing tobacco, cigarettes, electricity, car tires, natural gas, tea, coffee, alcohol (wine, beer) and many other products.

The duty calculation is based on the customs value of the product, taking into account the commercial invoice, as well as transportation and insurance costs. Excise duties in Denmark vary and include various categories of products, such as ice cream, coffee, videotapes, tobacco products, alcoholic beverages, chocolates, light bulbs, automobiles, fuel, disposable packaging and many others.

Income taxation of individuals

The Kingdom of Denmark has a system of income taxation, consisting of three thresholds: base, middle and highest. In the context of individuals, a fixed rate of income tax is required (for the benefit of the municipality), which is 32.6%. In addition, there is a graduated income tax of 5.64% (for income exceeding 42,000 Danish kroner, including capital gains) and 15% (for income exceeding 42,000 100 Danish kroner, including capital gains). These secondary levies affect the state budget. The graduated tax covers both labor earnings and capital gains, but the total taxation of personal income will not exceed 59%.

In the Danish territory, individuals who have reached at least 15 years of age (as well as younger income earners) are required to submit tax statements at the end of each tax year. The deadline for this is July 1, unless the taxpayer requests that the deadline be postponed. If individuals do not generate income or only earn income from gainful activity in Denmark, they are required to submit a simplified tax statement by May 1. For married couples, partners are required to tax their income individually.

Income tax

Since 1903, the Kingdom of Denmark has introduced a system of income taxation, which is divided into two main categories: a progressive state tax and a flat local income tax.

Income tax rates in Denmark in 2019 are as follows:

- 8% for those with earnings below 50,217 Danish kroner,

- 39.2% for income between DKK 50,217 and DKK 558,043,

- 56.5% for incomes above DKK 558,043.

In addition, in the Danish area there is an option to voluntarily file a church tax, which settles at an average of 0.92% (kirkestat rates range from 1% to 2%, depending on the local municipality). There is also a fluctuating municipal tax (kommuneskat), which averages around 24.84% and is remitted to the local municipality.

Each year in Denmark a new tax-free amount is set, which in 2019 was 10.10% on gross wages.

Those who pay taxes in Denmark are also required to register with the local tax authority and the Trade and Companies Authority, which can be arranged through the Danish Commerce and Companies Agency.

Danish Tax Authority's online services

In order to efficiently handle tax returns, deadlines and documents for both company employees in Denmark and entrepreneurs, you are encouraged to use the online services available on the Danish Tax Authority website (SKAT, www.skat.dk).

In order to conduct tax returns online, it is necessary to register in advance and obtain a dedicated TastSelv-kode (www.tastselv.skat.dk), consisting of 8 digits. This code also acts as a password to access the system. Having a personal TastSelv-kode (or NemID) opens access to your own tax information.

In Denmark, the Citizen Service Office, also known as Folkeregistret, as well as the Out-of-Country Service Offices, located in towns such as Odense, Copenhagen, Aarhus and Aalborg, are tasked with assigning tax identification numbers, known as the Central Person Register (CPR), for Danish employees and entrepreneurs. This number is necessary to obtain a health insurance card, giving access to free medical care. In order to obtain a CPR number, you are required to provide proof of identity, a rental agreement and an employment contract.

Important dates and necessary documents needed when paying taxes

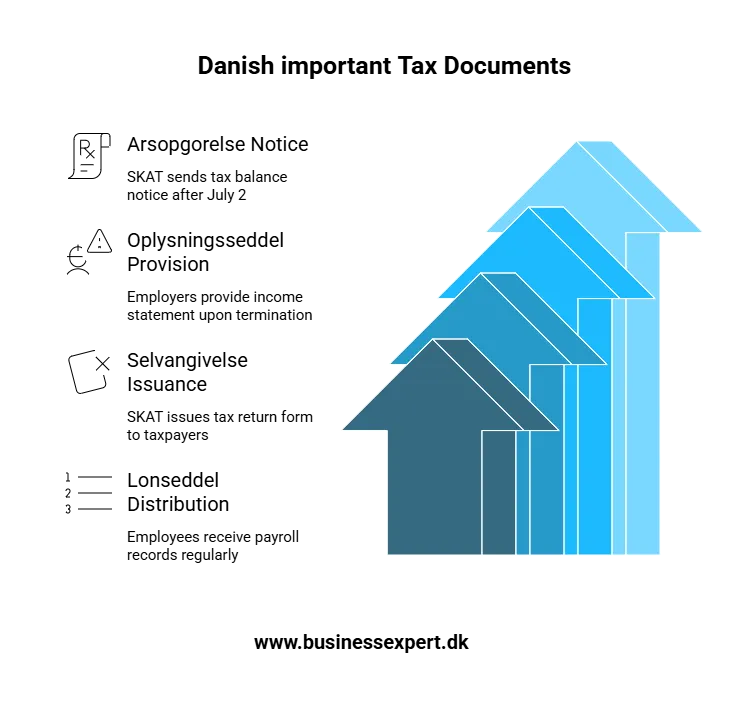

When it comes to tax paperwork in Denmark, there are a variety of letters, and below are some of them:

- Arsopgorelse is an official notice, prepared by SKAT and sent after July 2, containing important tax information, such as the tax balance to be paid or refunded.

- Oplysningsseddel, representing a consolidated statement of an employee's income. In Denmark, employers are required to provide this document to employees upon termination.

- Selvangivelse is a tax return form issued by the Danish Tax Authority (SKAT) and sent to the taxpayer's address indicated during registration, regardless of location.

- Lonseddel are payroll records that appear periodically, either weekly or monthly, depending on the pay period. Employees receive these records on a regular basis.

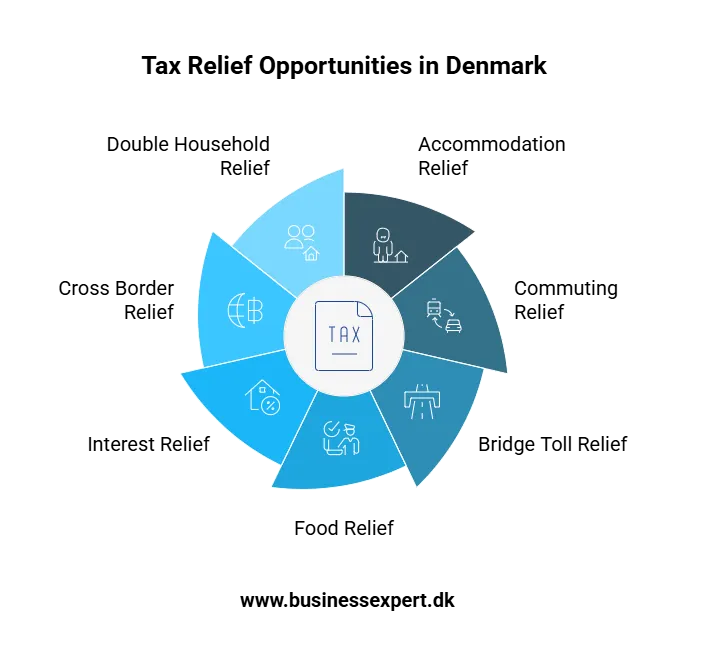

Tax benefits in Denmark

When it comes to tax paperwork issues related to working for a Danish company, there are various opportunities to take advantage of tax breaks that can significantly reduce your tax burden. These reliefs depend on the specifics of your situation and require the appropriate documents to apply.

Here is a list of the available reliefs and the documents needed to take advantage of each of them:

- Relief related to accommodation fees available to temporary employees of Danish companies. In order to apply this relief, it is necessary to provide a rental agreement, accommodation bills and bank statements confirming the charges. If the employer has made deductions from wages, pay slips must also be provided.

- Commuting relief, available to employees whose daily route to and from work is more than 24 km round trip. In order to apply this relief, receipts for fuel, public transportation tickets or other transportation are needed.

- Bridge toll relief, available to employees who cross toll bridges on their way to work.

- Food relief, available to all temporary workers.

- Relief related to interest on consumer loans and mortgages, available to employees whose majority of annual income is from Denmark. A bank certificate of interest paid and mortgage information is needed to apply this relief.

- Cross border relief, provided for employees whose majority of income is from Denmark. Married individuals must include their spouse's income. To apply this relief, Danish- or English-translated documents are needed.

- Double household relief, available to all employees who can document their household. In order to apply this relief, you need to provide the appropriate documents proving residency.

Remember that each relief requires compliance with certain required documents that prove eligibility for a particular tax exemption.

The most common doubts about the Danish tax system

- Tax residency in Denmark is related to the length of time you stay in the country. If your stay exceeds 6 months, you are considered a tax resident and pay taxes on both Danish and foreign income.

- Those with an annual income of up to 42,900 Danish kroner can claim a full refund of tax paid in Denmark.

- Filing a tax return in Denmark has different deadlines, either May 1 or July 1, depending on the case.

- In Denmark, every employee is required to file an annual tax return. Failure to file a return risks a penalty of about 5,000 Danish kroner.

- NemKonto is a special bank account for an employee to receive SKAT tax refunds and payment.

- Tax return and correction in Denmark can be filed up to 3 years and 4 months back.

- Limited tax liability applies to employees who work in Denmark but are non-residents. It applies only to income earned in Denmark.

- Personfradrag is a personal tax credit for Danish residents working for 12 months.

- NemID and Tastselv are codes needed for electronic tax return in Denmark.

- Ejendomsværdiskat is a tax on the value of real estate, including those outside the country.

- There are concessions and exemptions from the cadastral tax, such as for those over 65 or those renting property.

- Ejendomsskat is a tax on the value of land, taxing real estate.

- Skat til udbetaling is tax refund information.

- Forskudsopgorelse and Selvangivelse are tax cards in Denmark with a TastSelv number for online settlements.

- Feriepenge is a vacation benefit for legally working people.

- Personnummer is the equivalent of NIP in Denmark, needed for tax settlements.

- Sundhedsbidrag is the health insurance premium.

- Arbejdsmarkedsbidrag is the labor market contribution.

- Skattestyrelsen is the tax office in Denmark.

In the case of significant administrative formalities that carry a high risk of mistakes and legal sanctions, we recommend seeking the advice of a specialist. Please feel free to contact us if necessary.