Starting a business in Denmark

Advantages of investing in Denmark

Denmark is known as an attractive destination for international investors, who are attracted by the country's many favorable aspects. Its economy demonstrates stability, flexibility and openness, and its GDP index ranks among the top, both in Europe and globally. Compared to other European countries, Denmark's inflation rate looks remarkably moderate. There is no tiresome bureaucracy, and political, legal and taxation issues are clearly spelled out, a convenience for those from abroad as well. In addition, Denmark actively participates in organizations such as the European Union, the Council of Europe, the WTO, EFTA, the OSCE and the OECD.

A wide choice of educational opportunities translates into a high level of education, resulting in the availability of effective and well-prepared professionals in the labor market. This is certainly an advantage for prospective investors. The general proficiency in English among Danes makes it easier to communicate both in everyday life and in official matters, as well as in relations with the local community.

The process of establishing one's own company in Denmark is based on set standards for speed, clarity and low cost, making it one of the easiest processes internationally. Foreign companies enjoy equal rights compared to local businesses. The country's policy focuses on supporting business development, especially for small and medium-sized companies. Entrepreneurs are able to take advantage of a variety of grant, loan and credit programs. In addition, a diverse range of legal options allows the company structure to be tailored to individual requirements.

Corporate tax rates in Denmark are relatively low at 28%, which compares favorably with average rates in Europe. Costs for employers to pay social security and health insurance contributions are also relatively low and limited to 1% of total wages. What's more, many situations allow for the avoidance of double taxation thanks to agreements Denmark has with many countries, whether in Europe, Asia or America.

Denmark's various business legal models and registration process

When establishing a business in Denmark, you can choose from a variety of structural models, such as:

- a partnership company (Enkeltmandszirksmhed),

- a limited liability company (Anpartsselskab - ApS),

- limited partnership (Kommanditselskab - K/S),

- joint-stock company (Aktieselskab - A/S),

- general partnership (Intersselskab - I/S,

- representative office of a foreign company (Salgskontor),

- branch of an international company (Filial af udenelandsk selskab),

- cooperative association (Andelsforening/Brugsforening)

Sole proprietorship (Enkeltmandszirksmhed)

A sole proprietorship in Denmark is the most popular form of business. The process of registering this business is extremely simple, consisting of submitting a business plan and documents proving qualifications. The business can operate under the owner's name or a name of choice. It is worth noting that the owner bears full responsibility for the debts and obligations of the business, and is free to hire employees. If income does not exceed DKK 50,000 per year, no VAT is required.

Limited liability company (Anpartsselskab - ApS)

A limited liability company requires at least one partner and a minimum share capital of DKK 125,000. The registration procedure is simpler and more economical than in other legal forms. The partner is not personally liable for the company's debts, and the registration formalities are governed by the Danish Limited Liability Company Act. The separation of the company's assets from those of the owners is important. An executive board and a supervisory board can be appointed. Setup costs range from 3,000 to 5,000 Danish kroner.

Limited partnership (Kommanditselskab - K/S)

A limited partnership can be established, provided there are at least two partners. At least one acts as a general partner, and the other is a limited partner. The general partner is liable for the company's debts, the limited partner for the capital brought into the partnership.

Joint stock company (Aktieselskab - A/S)

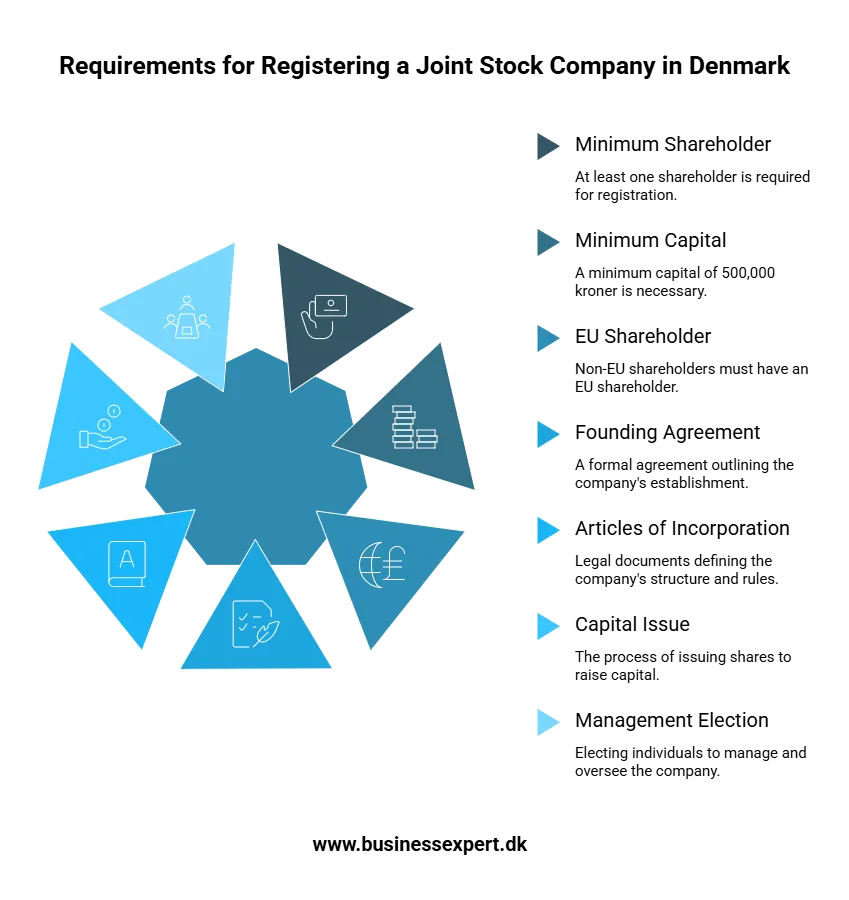

The joint-stock company is the most complex form, ideal for large listed companies. Registration is more complicated and requires meeting a number of criteria.

Registration includes:

- a minimum of one shareholder,

- a minimum of 500,000 kroner of capital,

- non-EU shareholders must have one from the EU,

- founding agreement, articles of incorporation, issue of capital,

- election of management and supervisory board.

Registration is a difficult but manageable process. It can cost from 4,500 crowns.

General partnership (Interesselskab - I/S)

A general partnership allows commercial operations and product processing. It has no formal legal personality. Requires an association agreement, at least two partners, no limitation of liability.

Representative office of a foreign company (Salgskontor)

If a foreign company wants to expand into Denmark, a branch office can be opened. This is advantageous because it does not require a lot of capital or additional expenses. Suitable if the company operates under Danish law. The owner must be from the EU.

Branch of a foreign company (Filialafundenlandskselskab)

Establishing a branch is a more challenging process. It requires an online application and information about the parent company.

Cooperative association (Andelsforening/Brugsforening)

Rarely selected option, allows commercial operations and processing. Allows limitation of liability. Name must include "A.m.b.a."

We also recommend reading our article on accounting for a business in Denmark.

The process of registering a Danish business

When beginning the steps of registering a company in Denmark, it is important to take into account the choice of the appropriate legal form, although certain aspects are fixed. For citizens who are members of the European Union, setting up a company in Denmark becomes more affordable and attaching a certificate confirming EU resident status is sufficient. The need for a NemKonto bank account is also a key element. Among other things, the process consists of documents such as the company's articles of incorporation and the identities of the founders, which allows for registration. An electronic NemID/MitID signature is also necessary, which allows access to government websites and platforms. In certain areas of business, there are times when special licenses or permits from relevant institutions are necessary.

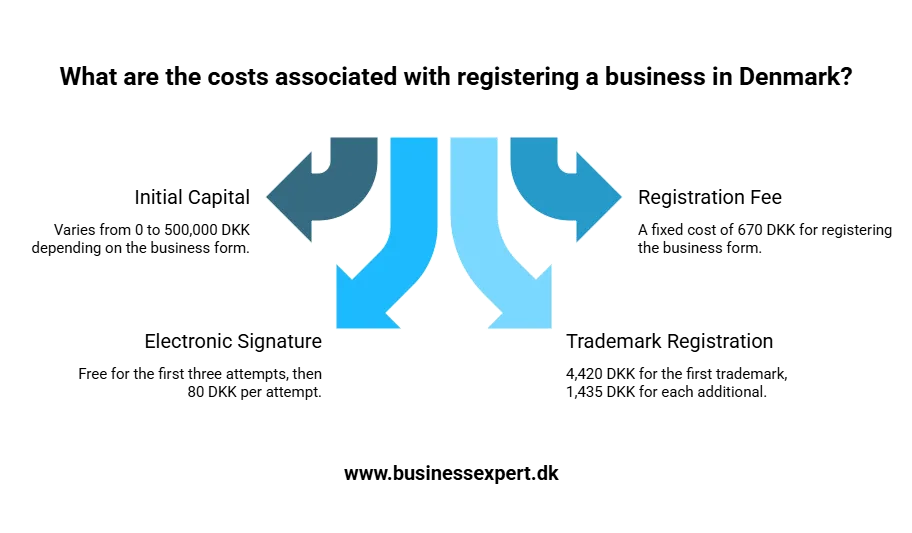

Associated costs associated with the company registration process in Denmark include:

- initial capital - depending on the chosen form, from 0 to 500 thousand Danish kroner,

- fee for registration of the form of ownership - 670 Danish kroner,

- processing of an electronic signature - the first three attempts are free, subsequent attempts cost 80 Danish kroner,

- registration of a trademark or logo - 4,420 Danish kroner for the first one, 1,435 Danish kroner for each additional one,

- support of a translator, notary or consultant - from 10,000 to 25,000 Danish kroner,

- use of a professional company offering assistance in registration - 65 thousand Danish kroner.

In the situation of successful registration, one receives various documents, including a certificate of incorporation, an extract from the DCCA register containing details of the company, an original certificate of participation, a seal, articles of incorporation with apostille, and a power of attorney.

Start-up Denmark

The content provides information on the obligation to register a business with the Danish Registry of Foreign Services (RUT) before starting operations in Denmark, as well as the need to report any changes in the operation of the company. The Start-up Denmark program, a joint initiative of the Danish Ministry of Business and Development and the Ministry of Immigration, Integration and Housing, provides an alternative for investors from outside the country. It not only makes it easier to start a business in Denmark, but also allows two people to obtain a residence permit for up to two years. The main goal of the program is to encourage foreign investors to develop their businesses in Denmark, thus contributing to the country's economic growth.

To participate in the Start-up Denmark program, it is necessary to have an innovative business idea that will add value to the Danish economy. Proposals from investors outside the country undergo evaluation by a panel of experts who decide whether to accept or reject the proposals submitted. It is worth noting that the program does not include entrepreneurs who plan to open a restaurant or grocery store. The investor should hold shares in the country of his citizenship and not collect dividends. In addition, he or she must have an adequate amount of funds to cover the living expenses of one person or the whole family for a year.

- Submission of the business plan - The business plan must contain essential elements, such as a description of the products or services offered, a detailed business model and the necessary skills of business partners.

- Awaiting a decision - After submitting the business plan, the investor awaits the Danish expert's opinion. A response is usually obtained within six weeks. The decision to accept or reject the plan is communicated by official letter.

- Submission of applications - If the expert approves the business plan, the investor must submit two applications: for participation in the program and for a residence permit. These applications are submitted to the Danish Agency for International Recruitment and Integration.

- Final Decision Confirmation - After going through the previous stages, the investor waits for a final response from the program organizers. The average waiting time is about four weeks. Once the applications for participation in the program and the residence permit are approved, the out-of-country investor can move to Denmark and take steps toward developing the planned business.

Entrepreneurs who have successfully gone through the entire Start-up Denmark program process get access to the same privileges enjoyed by local entrepreneurs. They can take advantage of state subsidies and support programs, make business contacts and operate freely in the European market. In addition, they are entitled to free consultations at a business support center. The foreign investor and his family can also enjoy social benefits, including the health care and education systems.

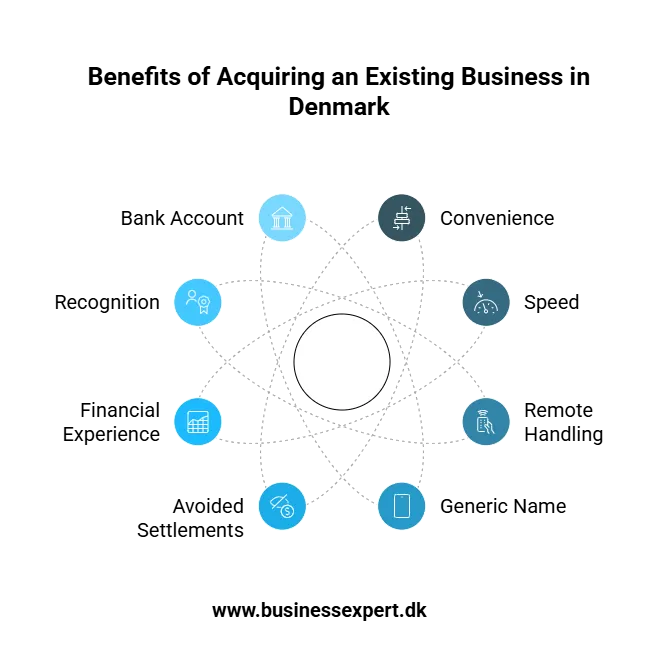

Buying an existing company

An alternative option to starting a new company is to take over an existing business. In Denmark, such an option is convenient as well as fast, and all paperwork can be handled remotely. Typically, companies available for acquisition have been in operation for several months and have a generic name, allowing for a variety of uses. Those who acquire such companies can enjoy the benefits of avoided settlements with previous obligations, gained experience in financial matters and recognition among banking institutions, government agencies and business partners. The only thing to remember is to open a bank account for the newly acquired company.

Taxation in Denmark

In Denmark, all citizens who are engaged in business or are employed are required to pay their tax obligations. The structure of the tax system is based on the progressive principle, where tax rates depend on the level of income. Danish taxpayers are allowed to deduct certain expenses, but it is necessary to provide proper documentation to support these expenses. When in doubt, the Tax Office conducts audits.

There are two types of tax liability in Denmark: full and limited, depending on various factors, such as place of residence, type and amount of income, as well as place of work. Those with limited tax liability are not required to pay tax on income earned in Denmark.

For those who plan to start their own business in Denmark, it is important to register their company with the Agency for Enterprise and Trade. It is also worth remembering that there are no special tax breaks for entrepreneurs in Denmark. This means that when doing business in Denmark, you will have to follow the general rules of taxation.

Tax payments in Denmark include:

- Personal income tax - This tax is payable by each individual and is based on a tax rate of 32% for all income. Progressive tax rates depend on the level of income, with income below a certain amount subject to a lower progressive rate.

- Tax on sole proprietorships - Income from a sole proprietorship is considered income for the owner, which means that taxation is conducted on an individual basis. Tax returns are filed quarterly or semi-annually online.

- Corporation Tax (CIT) - Companies in Denmark are required to pay a corporation tax (CIT) of 28%. This is based on the principle of consolidation, which includes not only the main company, but also its subsidiaries and affiliates.

- VAT - Companies with an annual turnover of more than DKK 50,000 must register as VAT payers. The VAT rate is 25% and is imposed on goods and services.

- Excise taxes - These are levied on specific groups of products, such as alcoholic beverages, tobacco products, engine fuels, and food products.

Business owners in Denmark are required to pay their tax obligations depending on their financial situation and the type of business they operate.

Residence and business visas in Denmark

In the context of European citizens residing in Denmark without the relevant stop documents, it is possible to stay legally for a period not exceeding 3 months. Such a stay does not require documentation formalities. However, in the case of a planned longer stay, exceeding 3 months, it is necessary to apply for registration of residence within the European Union before the end of this period. Receipt of an EU registered residency certificate is formal confirmation of legal residence in Denmark. To obtain this certificate, it is necessary to provide justification for the extended stay. In doing so, it is worth mentioning that citizens of Scandinavian countries are exempt from the requirement to have documents proving residence.

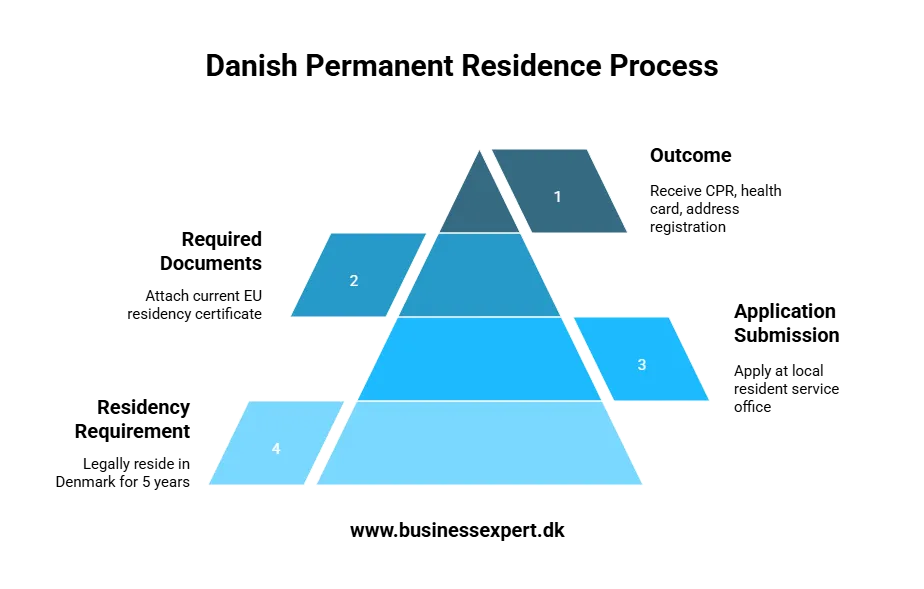

For those who have legally resided in Denmark for at least 5 years, it is possible to apply for permanent residence status. To do so, you must apply at the local resident service office (Borgerservice), usually located in the municipality. You will need to attach a current certificate of EU registered residency. The process results in an identification number (CPR), health insurance card and address registration. The rules related to the residence of EU citizens in Denmark are established under EU-opholdsbekendtgørelsen.

Regarding business visas, those planning to travel to Denmark for business purposes, such as negotiating contracts or attending business meetings, can apply for a special visa. The process for obtaining a business visa is similar to the Schengen visa procedure and requires an invitation from a Danish company or business partner. The invitation should include details of the purpose of the trip, dates, accommodation and financial support. The visa application is submitted to the Consular Section of the Danish Embassy or the Visa Center, at the earliest 3 months before the planned travel date and at the latest 2 weeks before that date. A visa decision is usually issued within 10 days, and the fee is 27 euros. In some situations, the waiting time may be longer - up to 1 or 3 months in exceptional cases. For subsequent visa applications within 5 years, using a travel agency can simplify the application process.

When applying for a business visa, you will be required to provide various documents, such as a completed application form, consent to process personal data, confirmation of the visa fee, an official invitation from a Danish company or business partner, copies of passport pages, proof of purchase of health insurance, 2 photographs of the applicant, and a bank statement. It is also possible that additional documents will be required, such as tax documents, registration information, powers of attorney or an itinerary.

Labor rights in Denmark

Within a country, there are two different groups of regulations relating to labor rights, focusing on the employment of physical and intellectual people. Each employer is required to provide adequate training in health and safety issues, proper wages, and provide coverage for occupational diseases or accidents. Failure to properly follow these guidelines can result in protests, disruption of operations and violations of labor relations.

- Labor environment

In the case of this country, there is no unified normative act governing labor and employer relations. Elements such as working hours, notice periods, the lowest length of time off and retirement age are determined through agreements between the Federation of Trade Unions and the Confederation of Employers. Such agreements between workers and employers should be in writing; verbal agreements are invalid. Negotiations for raises can take place every 2 years, and the labor contract can be rethought every 4 years.

- Working hours

The basic working time for employees in this country is 37 hours per week. Work outside of this time, the first 3 hours overtime, or the first 3 hours performed in the employee's free time, are treated as overtime. Overtime pay is 50%, unless the employee exceeds 3 extra hours in one day or works on holidays, in which case the premium increases to 100%. The employee has a choice between additional overtime pay or taking time off. Part-timers have the same rights as full-time employees.

- Wages

Under the country's laws, no fixed minimum wage is set. Instead, wage and job issues are negotiated between employers and employees. Although a general minimum wage is not set at the level of the entire labor market, collective agreements set the lowest wages in specific fields and occupations. Wages depend on the type of work and can be expressed as an hourly, daily or monthly rate. Payments can be given once or twice a month, and earnings levels in different industries are updated annually.

- Vacation

Vacation issues in the state are regulated by relevant laws. Each employee is entitled to a total of five weeks of vacation, equivalent to 30 days, including Saturdays. Employees working in the third shift receive 2 hours of additional vacation for each week worked in that shift. At least 18 days of vacation must be taken between May 1 and September 30. If an employee has not had the opportunity to work the entire previous calendar year, available vacation is calculated based on full months of work, granting 2.08 days of vacation for each of those months.

- Social insurance

The country's social insurance system covers all employees operating in the area. Insurance premiums are paid by employers on employees' wages. These contributions amount to about DKK 1,080 per year. Employers in this country contribute between 10,000 and 12,000 Danish kroner annually to social insurance related to employees.

- Occupational health and safety

Entrepreneurs doing business in the country are required to comply with occupational health and safety regulations. This information is available on the country's official Labor Inspectorate website. Companies with at least 10 employees must also set up a structure to deal with health and safety issues, with designated inspectors. Their goal is to implement and enforce safety standards. Organizations with dynamic or temporary workplaces are also subject to these regulations. Failure to comply with health and safety rules can lead to financial penalties and halting of work.

- Termination of the employment relationship

Each form of termination has an individual notice period, which varies depending on the length of service. The length of this period is subject to negotiation between the employer and the employee. Regulations related to the termination of the employment contract are defined in collective agreements and vary depending on the sector and role of the employee. An employee who has spent at least nine full months with the company and has reached the age of 18 can only be dismissed with specific justification. If the employee finds the dismissal unjustified, he has the right to appeal to the court. If the employer is found to have acted unreasonably, he must pay the employee appropriate compensation. Recall that there is an exceptional situation in which an employer may dismiss an employee immediately and without notice if the employee's behavior is exceptionally wrong.

- Collective agreements

Collective agreements are agreements designed to protect employees working in the country on issues related to their employment. Such agreements address, among other things, working conditions, wages, workplace safety, place and time of work, vacations, overtime and much more. These agreements are negotiated by representatives of both employees and employers. An employer can join a collective agreement, especially if it is already a member of an employers' union. It is worth noting, however, that employees' membership in a particular labor union does not mean that the company automatically implements the norms and conditions set by the union within the framework of collective agreements.

Tax identification number and tax card

In Denmark, people with limited income enjoy an exemption from paying taxes by receiving a special "frikort." Entrepreneurs and foreign investors, on the other hand, need a tax identification number and a tax card. The tax card is delivered electronically, with the TastSelv tool responsible for its access. To obtain a tax identification number and tax card, you need to fill out the appropriate application, available online or as form 04.063. The application can be submitted from 60 days before you plan to start your business in Denmark. Attaching a copy of an identity document (such as an ID card or passport), a residence permit, an employment contract (if necessary) and, in the case of a marriage, a marriage certificate, is essential to the completeness of the application.

Register of Foreign Service Providers

It was emphasized that it is necessary to register the company's activities with the Registry of Foreign Service Providers (RUT) before operating in Denmark. The need to report any changes in the company's operations was also pointed out. The process of enrolling in the RUT is simple and quick, conducted through the virk.dk web portal. One enters information such as the company's name, registered office, type of services, location, planned period of operation, CVR and VAT numbers, sector classification, contact information for the registrant and information on employees sent on assignment. Upon successful registration, one is given one's own RUT number, which is necessary when dealing with the authorities in question. Failure to register in the RUT or failure to report changes in activity may result in a fine or a procedure conducted by the Labor Inspectorate.

Closing a company in Denmark

The required paperwork for closing a company in Denmark includes adjusting the tax return, which is an essential step. To achieve this, it is necessary to visit the Tax Office and provide the necessary information that will be used to calculate the tax due to be paid. The question of exactly where you need to file your tax return depends primarily on factors such as where you live and the type of work you do. Filling out the form before the end of the activity is based on the tax capacity of the person, hence the form varies depending on his situation.

Tax capacity is classified into two categories:

- Limited tax capacity:

- Residing in your home country for more than six months during a calendar year.

- Working or conducting business in Denmark.

- Concentrated life interests in the home country.

- Partner or spouse residing in the home country.

- Full tax capacity:

- Living in Denmark or residing there for more than six months during a calendar year.

- Working or conducting business in Denmark.

- Concentrated life interests in Denmark.

- Partner or spouse residing in Denmark.

It is worth noting that an individual's situation may vary and may not necessarily meet the criteria for limited or full tax capacity. If an individual lives and works in Denmark and in the country of origin, it is ultimately where most of the life interests and residence of the partner or spouse are located that determines permanent residence. For example, if the partner lives in the home country, that country is treated as the permanent residence. The same applies if Denmark is the place of concentration of life interests and the partner lives in Denmark. In addition to changing your tax return, it is important to notify the tax office of your new address and remove yourself from the Danish national register, which can be arranged at your local resident service desk.

Is it worth opening a business in Denmark?

Denmark is seen as an attractive destination for foreign investors, attracting them with many favorable features. Its economy stands out for its stability, openness and flexibility, and its GDP is among the highest both in Europe and globally. Inflation in the country is moderate compared to other European countries. Bureaucracy is not a problem, and policy, legal and tax issues are clearly spelled out, making it easy for foreigners to navigate. Denmark actively participates in organizations such as the EU, Council of Europe, WTO, EFTA, OSCE and OECD.

Abundant educational opportunities contribute to a high level of education, which translates into the availability of skilled workers in the market, providing an advantage to potential investors. The high level of English proficiency in Danish society facilitates communication in everyday life, as well as in official contexts and with local people.

The process of setting up a business in Denmark is characterized by standards of speed, simplicity and low cost, making it one of the most concise on a global scale. Foreign companies are treated on an equal footing with Danish companies. The country's policy is aimed at supporting business, especially small and medium-sized companies. Entrepreneurs have access to a variety of grant programs, loans and credits. Various forms of legal structure allow businesses to be tailored to personal requirements.

Corporate tax rates in Denmark are relatively low, at 28%, an advantage over average European rates. Employers' social and health insurance contributions are also relatively low, limited to 1% of the wage fund. In addition, double taxation is mostly avoided thanks to agreements Denmark has with numerous countries, whether in Europe, Asia or America.

In the case of significant administrative formalities that carry a high risk of mistakes and legal sanctions, we recommend seeking the advice of a specialist. Please feel free to contact us if necessary.